¿ORO???

If you know anything about personal finance, you probably know who Dave Ramsey is. He is a popular Christian personal finance expert, specifically in the area of debt reduction. He has helped thousands reduce debt and get their life back together. Recently, he got some flack from the media for slamming the purchase of physical gold. Here is an excerpt from one of his articles:

"From 1833 to 2001, the compound annual growth rate of gold was only 1.54%. That's pretty rotten. Since September 11, the value of gold has definitely increased. It's looking better right now. But you can't deny nearly two centuries of consistently poor performance. Gold is the new Snuggie.

You buy it off late-night cable and end up looking stupid. Everyone is talking about it, and everyone wants to get involved. But think about it. If you were going to invest in gold at all, would you really want to buy it at its 176-year high? Absolutely not! So what's gold good for—other than wearing it around your neck or wrist? Well, if you're in debt—or if you just need a little extra cash—sell it!"

He throws a little bit of humor in there but he has some good points. Gold is a pretty ridiculous investment, especially right now. With gold right around $1500/oz, gold is in a bubble ready to burst. I just don't buy into the impeding doom that is publicized on the media. Another one of my personal finance idols is Warren Buffet. I love his no nonsense outlook on investing and his success is another reason I listen to him. Here is his take on gold:

"Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head."

and another:

"You could take all the gold that's ever been mined, and it would fill a cube 67 feet in each direction. For what that's worth at current gold prices, you could buy all -- not some -- all of the farmland in the United States. Plus, you could buy 10 Exxon Mobils, plus have $1 trillion of walking-around money. Or you could have a big cube of metal. Which would you take? Which is going to produce more value?"

Buffet makes an investment in gold sound laughable, and it is. But why do I personally refuse to buy physical gold? Here are my reasons:

-There is no inherent value to physical gold. It's a dirty rock, nothing more, nothing less. If you think about it, it's pointless. It just looks cool. Did you know that even if you owned gold, gold has a negative cash flow? It not only costs money to store gold but also has serious tax implications.

-If a crisis does happen, why would I want your gold? It doesn't do anything for me. I would much rather own stock piles of fresh water, food, guns and ammunition. THOSE are assets that are worth something because they have value. Gold has no value.

-Gold is in a bubble right now. Don't listen to the pundits telling you to buy gold at $1500/oz because they think it will go up to $5000/oz. That is insanity. I estimate that gold will have a major correction within the next year. Unfortunately, those who bought gold at the highs are in for a rude awakening.

-Perception of gold changes all the time. That is a dangerous investment because you are investing in something that has zero intrinsic value. It's worth is coming from what people think it's worth. Invest in stocks instead. Companies actually produce assets, whereas gold just sits in a vault.

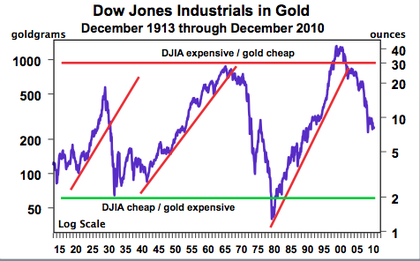

-Over the last couple hundred years, gold has been a terrible investment. Just looking at the volatility makes me sick. However, the recent bull run has made some people a pretty penny. There's no doubt about that. However, are you willing to risk a large chunk of your portfolio on a single commodity? If you have the risk tolerance for this, go for it. I'll sit back and watch ;)

At the end of the day, my biggest beef with gold is that I hear more and more people selling their stocks to pick up gold at these outrageous prices. The main reason I have beef with gold is because you're putting your money in one basket. I recommend broad diversification of your money. Invest in a broad range of ETF's and index funds instead. Mark my words, you will thank me someday.

Read more: http://business.ezinemark.com/dave-ramsey-and-warren-buffett-say-no-to-gold-17b1075fcd2.html#ixzz1IV9muEu5

Under Creative Commons License: Attribution No Derivatives

http://business.ezinemark.com/dave-ramsey-and-warren-buffett-say-no-to-gold-17b1075fcd2.html

“Los dos guerreros más poderosos son paciencia y tiempo.” (León Tolstoi)