#1

Pagaya Technologies stock: All Eyes On Next Year 2025 - Acciones USA

Pagaya Technologies (Nasdaq:PGY) released Pagaya Technologies (Nasdaq:PGY) released third-quarter results on November 12. Results have been mixed, with revenue reaching $258 million (beat by $4.08 million) and EPS GAAP of -$0.93 (miss by $0.74).

The company is dedicated to granting loans to applicants through an artificial intelligence algorithm that analyzes millions of data in a second to determine if the applicant is suitable to receive the funds. The AI algorithm is integrated into the system of the partner lenders (US Bank, etc.). Once an applicant is accepted, funds are collected through the platform from investors who provide the funds necessary to grant the loan. Pagaya receives a commission for this entire transaction.

After the results were published, the stock price plummeted almost 50% in two sessions because the market expected an EPS GAAP of -$0.19 and the final data was -$0.93. The reason for this difference seems to have been in the value losses of some loans generated during 2023. Thus we find the accounting item “Loss due to impairment of certain investments” of $81.82 million in the financial statements for the third quarter. According to Pagaya, the abnormally high interest rates that the markets suffered during the past year 2023 have caused the loans granted in that period to have had very narrow profitability margins for Pagaya, margins so narrow that in many cases they have been devoured by losses due default, which has caused Pagaya to have had to allocate a large part of these loans to losses. According to the company, there are still $275M of 2023 loans on balance that could potentially generate more losses due to defaults in the 4Q of this year 2024, but these possible losses would be the last to be accounted for. Therefore, from 2025, Pagaya does not expect to register high amounts for this concept.

Because the company had not explained these circumstances in the Q3 CC, the market reacted with a sharp drop, with the price reaching a minimum of $8.20 in the following sessions after the results.

Pagaya shareholders have been suffering from the stock's volatility for several months, so when the price begins an upward rally, Pagaya reports some news (public offering, convertible debt issue, unexpected loss report, etc.) that causes a collapse in stock price.

In my opinion, we are facing the last unpleasant chapter in this story, since, as the company itself stated in Q3 CC, only $275M of loans generated in 2023 remain on the balance sheet, which will probably cause impairment losses in the results of the next Q4 2024. Starting in 2025, these losses will decrease drastically, which will help achieve Pagaya´s big goal for next year 2025: GAAP profitability.

Why, despite this long journey of volatility, do I still trust Pagaya's managers? I have two reasons for this:

- Pagaya has been meeting and even beating all its forecasts in recent quarters in terms of various business parameters (Revenue, Network volume, adjusted EBITDA, etc.). Why won't they now meet their goal of achieving profitable GAAP during 2025?

- The unexpected losses reported in the last two quarters (Q2 and Q3) have been caused, not by the poor performance of the loans retained on the balance sheet, but by the high interest rates that affected the markets last year in 2023. According to Pagaya, these high interest rates caused an increase in the cost of the funds obtained to finance the retained loans, which greatly narrowed the margins. By not having a sufficient cushion, the default on loans has caused profitability to be negative, which is why Pagaya is now allocating these losses to results.

Pagaya has stated that thanks to the reduction in interest rates initiated by the FED in 2024, this problem with loan losses will end in 2025.

Personally, I think it makes sense that losses of loans granted in 2023 are now emerging, but what I think the company could have done better is to have communicated all this in previous quarters. Perhaps, if Pagaya had warned of these possible losses in Q1 or Q2 of 2024, the market would not have reacted so badly after the publication of the Q3 results. In fact, Pagaya seems to have learned its lesson and has warned that more losses due to impairments (the latter of high value) will most likely be reported in the next Q4.

The market wants Pagaya to be profitable and viable in the long term. Pagaya has already demonstrated that it has the capacity to grow at good rates, and must now focus on achieving profitability. To achieve this, it is essential to efficiently manage the credit risks. The company reported some time ago that they had improved the AI algorithm to improve the credit quality of loan applicants. Thus, the criteria required of applicants were modified, such as increasing the minimum annual income bar to $120,000, seniority in the job, etc.

These changes have meant a better performance of the loans granted since 2023, with a drop in the delinquency rate of between 20% and 40% compared to the peak of 2022. In addition, the rating agency Kbra, which is the agency that issues ratings for Pagaya's ABS issues, has upgraded the credit ratings of several issues in recent months. All of this makes me feel more confident that Pagaya is focusing on improving loan default risk.

In any case, we will have to wait until the first or second quarter of 2025 to verify that loan impairment losses have indeed been drastically reduced. Pagaya has a lot at stake in this regard. In the event that Pagaya finally manages to reduce these losses and reach the GAAP profitability milestone, given the great undervaluation that the shares currently present, its price will experience a strong revaluation that could lead it to rise x3 or x4 compared to current prices.

Otherwise, if the company fails to adequately manage the credit risk of the loans granted and has difficulties in achieving GAAP profits throughout the next year 2025, the share price will most likely fall to levels lower than those observed in the last few days.

In my opinion, and as I have explained previously, I am confident that Pagaya will finally achieve a positive GAAP EPS by next year 2025.

Pagaya: A story of growth

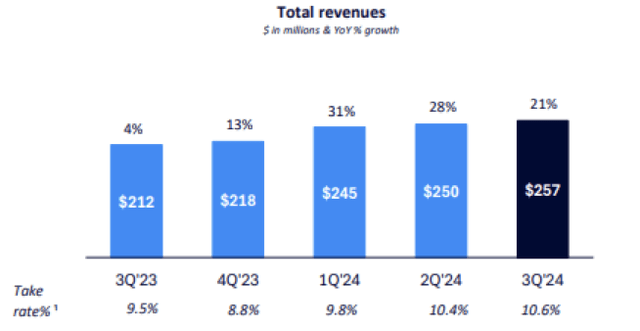

As we have commented previously, the performance of the business in terms of growth has been excellent in recent quarters. Revenue has not stopped growing at rates above 20% in the last three quarters, as can be seen in the following graph:

Pagaya

Source: Pagaya

This increase in revenue has been largely due to the increase in the volume of the Network, as a result of the growing number of partners, which is allowing Pagaya to access an increasing volume of loan applicants. In this sense, the company announced a few weeks ago the incorporation of another new top-5 bank, which will become the second top-5 bank partnership (the first was US Bank). They are also in negotiations with several top-20 banks.

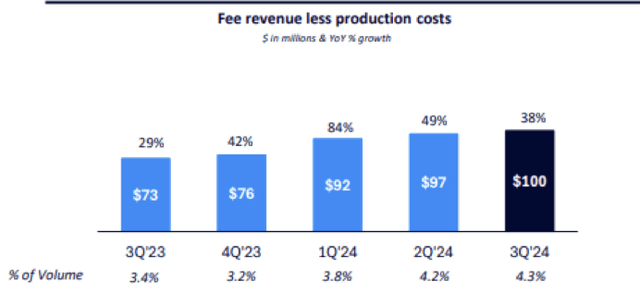

On the other hand, operating margins are improving, showing a steady increase in operational efficiency. This efficiency is measured by Pagaya with the FRLPC (Fee Revenue Production Cost) parameter, which has been growing constantly during the last quarters:

Pagaya

Source: Pagaya

As you can see, the business has grown steadily over the past few quarters. However, this good revenue performance has not been reflected in the earnings of recent quarters. If we look at the income statement for the last two quarters (Q2 and Q3) there is a loss item “other expenses” that has presented high amounts. This item has included various expense items such as stock-based compensation (SBC), loan and securities impairments, etc. It is in “impairments of loans and securities” where the key lies for Pagaya to reach the GAAP profitability milestone in the coming quarters and where the market will be focused. This accounting item includes the losses caused by the loans that Pagaya maintains on its balance sheet, losses that have reached high figures ($56M in Q2 and $82M in Q3). According to Pagaya, this has been due to the fact that, although the loans have shown good performance in terms of delinquencies as of 2023, the high financial costs incurred in obtaining the funds have meant a narrowing of the margins and there have not been a sufficient cushion to absorb loan defaults. This situation, according to Pagaya, is only occurring with loans granted in 2023. Starting in 2024 and thanks to the reduction in interest rates, the lower cost of funds has made it possible to increase the sufficient cushion to absorb future defaults. In the third quarter CC, the company stated that of those 2023 loans without sufficient cushion, there is still $275 million in balance and that they believe the latest impairments associated with them will be resolved in the upcoming fourth quarter of 2024. If this is so true the goal of a positive GAAP EPS would not be far away. In fact, Pagaya estimates that it will be achieved throughout 2025.

Evolution of impairments of certain loans and loan holdings on the balance sheet:

|| || ||Q1 2023|Q2 2023|Q3 2023|Q4 2023|Q1 2024|Q2 2024|Q3 2024| |Impairments on certain loans and securities|$21.4M|$4.23M|$9.13M|$12.6M|$26.85M|$80M|$81.8M| |Loans in BS|$503.8M|$588.31M(16,6%)|$665.45M (13,09%)|$714M (7,3%)|$892M (25%)|$909M (1,9%)|$912M (0,33%)|

Source: Author

In the table above you can clearly see two well-defined trends during the last quarters:

1- Growing trend of impairments.

2- The decreasing trend of loans and securities retained on the balance sheet.

In terms of impairments, the greatest growth has occurred in Q2 and Q3 of the current year 2024. Impairments are also expected for the next Q4, although they will most likely be lower than those recorded in Q3 ($81.8M) since only $275M originated in 2023 remains currently in balance. And starting in the first quarter of 2025, the number of these impairments is very likely to be drastically reduced. This downward evolution will be the key for Pagaya to achieve the positive GAAP EPS target.

Looking at the loans held on the balance sheet, you can see from the chart above that growth is clearly slowing. This is because, although the volume of loans generated is increasing, the % risk retention has been falling from more than 5% last year 2023 to an average of 2.5%-3% today thanks to new financing structures with lower requirements.

Therefore, decreasing the evolution of the impairments of loans and certain securities and decreasing the evolution of the holding of loans on the balance sheet; are two fundamental objectives for Pagaya for next year 2025.

Pagaya stock valuation>>> Only X3,5 current year 2024 Adjusted EBITDA

Pagaya estimates that the adjusted EBITDA for the current year 2024 will be around $200M. This is only X3.5 of the current market value ($700 million). In reality, it is a very very low valuation, taking into account that the average peers´s valuations are above x20.

So if we compare it to some of its peers: Sofi (Nasdaq:Sofi) Adjusted EBITDA X21 and MoneyLion (Nasdaq:ML) X24.

We are saying that for Pagaya to approach the market valuation of its peers, it would have to be valued at around $4B ($200MX20), that is, about $60 per share.

Although it may seem like a high price compared to the current price ($10.50 at the time of writing this article), if the results of the next quarters show enough business growth, and above all, it is possible to achieve GAAP profitability, I am convinced that that price ($60) could be reached without problems in a few months.

Risks

As with any company, there are a series of risks that every investor must take into account:

There is a risk that Pagya will ultimately fail to reduce impairments and, therefore, GAPP's profitability target will not be achieved throughout next year 2025.

On the other hand, since Pagaya still has negative net cash flow, it may have to make some offerings in the coming months to increase liquidity.

Conclusion

Pagaya presented its third quarter 2024 results on November 12. Results were mixed, with revenue of $258 million and GAAP EPS of -$0.93.

Although the revenue figure has been higher than expected, the GAAP EPS figure has been lower. The reason has been an expense item "credit impairment of certain loans and securities" that has been much higher than expected. This expense item has its origin in losses on loans granted in 2023 due to high financial costs that caused a narrowing of margins.

Pagaya affirms that these impairments will end up being cleaned in the next Q4 of 2024, and from 2025 the amount will decrease, making it easier to achieve the GAAP profitable objective.

With a current market valuation of just 3.5 times adjusted EBITDA, Pagaya is severely undervalued. Looking at the valuations of its peers, the stock price should be around $60. We are, therefore, facing a company that has impressive revaluation potential and that I believe will finally explode throughout next year 2025.

Upvote0Downvote0Ir a los comentariosCompartirCompartir

third-quarter results on November 12. Results have been mixed, with revenue reaching $258 million (beat by $4.08 million) and EPS GAAP of -$0.93 (miss by $0.74).

third-quarter results on November 12. Results have been mixed, with revenue reaching $258 million (beat by $4.08 million) and EPS GAAP of -$0.93 (miss by $0.74).

The company is dedicated to granting loans to applicants through an artificial intelligence algorithm that analyzes millions of data in a second to determine if the applicant is suitable to receive the funds. The AI algorithm is integrated into the system of the partner lenders (US Bank, etc.). Once an applicant is accepted, funds are collected through the platform from investors who provide the funds necessary to grant the loan. Pagaya receives a commission for this entire transaction.

After the results were published, the stock price plummeted almost 50% in two sessions because the market expected an EPS GAAP of -$0.19 and the final data was -$0.93. The reason for this difference seems to have been in the value losses of some loans generated during 2023. Thus we find the accounting item “Loss due to impairment of certain investments” of $81.82 million in the financial statements for the third quarter. According to Pagaya, the abnormally high interest rates that the markets suffered during the past year 2023 have caused the loans granted in that period to have had very narrow profitability margins for Pagaya, margins so narrow that in many cases they have been devoured by losses due default, which has caused Pagaya to have had to allocate a large part of these loans to losses. According to the company, there are still $275M of 2023 loans on balance that could potentially generate more losses due to defaults in the 4Q of this year 2024, but these possible losses would be the last to be accounted for. Therefore, from 2025, Pagaya does not expect to register high amounts for this concept.

Because the company had not explained these circumstances in the Q3 CC, the market reacted with a sharp drop, with the price reaching a minimum of $8.20 in the following sessions after the results.

Pagaya shareholders have been suffering from the stock's volatility for several months, so when the price begins an upward rally, Pagaya reports some news (public offering, convertible debt issue, unexpected loss report, etc.) that causes a collapse in stock price.

In my opinion, we are facing the last unpleasant chapter in this story, since, as the company itself stated in Q3 CC, only $275M of loans generated in 2023 remain on the balance sheet, which will probably cause impairment losses in the results of the next Q4 2024. Starting in 2025, these losses will decrease drastically, which will help achieve Pagaya´s big goal for next year 2025: GAAP profitability.

Why, despite this long journey of volatility, do I still trust Pagaya's managers? I have two reasons for this:

- Pagaya has been meeting and even beating all its forecasts in recent quarters in terms of various business parameters (Revenue, Network volume, adjusted EBITDA, etc.). Why won't they now meet their goal of achieving profitable GAAP during 2025?

- The unexpected losses reported in the last two quarters (Q2 and Q3) have been caused, not by the poor performance of the loans retained on the balance sheet, but by the high interest rates that affected the markets last year in 2023. According to Pagaya, these high interest rates caused an increase in the cost of the funds obtained to finance the retained loans, which greatly narrowed the margins. By not having a sufficient cushion, the default on loans has caused profitability to be negative, which is why Pagaya is now allocating these losses to results.

Pagaya has stated that thanks to the reduction in interest rates initiated by the FED in 2024, this problem with loan losses will end in 2025.

Personally, I think it makes sense that losses of loans granted in 2023 are now emerging, but what I think the company could have done better is to have communicated all this in previous quarters. Perhaps, if Pagaya had warned of these possible losses in Q1 or Q2 of 2024, the market would not have reacted so badly after the publication of the Q3 results. In fact, Pagaya seems to have learned its lesson and has warned that more losses due to impairments (the latter of high value) will most likely be reported in the next Q4.

The market wants Pagaya to be profitable and viable in the long term. Pagaya has already demonstrated that it has the capacity to grow at good rates, and must now focus on achieving profitability. To achieve this, it is essential to efficiently manage the credit risks. The company reported some time ago that they had improved the AI algorithm to improve the credit quality of loan applicants. Thus, the criteria required of applicants were modified, such as increasing the minimum annual income bar to $120,000, seniority in the job, etc.

These changes have meant a better performance of the loans granted since 2023, with a drop in the delinquency rate of between 20% and 40% compared to the peak of 2022. In addition, the rating agency Kbra, which is the agency that issues ratings for Pagaya's ABS issues, has upgraded the credit ratings of several issues in recent months. All of this makes me feel more confident that Pagaya is focusing on improving loan default risk.

In any case, we will have to wait until the first or second quarter of 2025 to verify that loan impairment losses have indeed been drastically reduced. Pagaya has a lot at stake in this regard. In the event that Pagaya finally manages to reduce these losses and reach the GAAP profitability milestone, given the great undervaluation that the shares currently present, its price will experience a strong revaluation that could lead it to rise x3 or x4 compared to current prices.

Otherwise, if the company fails to adequately manage the credit risk of the loans granted and has difficulties in achieving GAAP profits throughout the next year 2025, the share price will most likely fall to levels lower than those observed in the last few days.

In my opinion, and as I have explained previously, I am confident that Pagaya will finally achieve a positive GAAP EPS by next year 2025.

Pagaya: A story of growth

As we have commented previously, the performance of the business in terms of growth has been excellent in recent quarters. Revenue has not stopped growing at rates above 20% in the last three quarters, as can be seen in the following graph:

Pagaya

Source: Pagaya

This increase in revenue has been largely due to the increase in the volume of the Network, as a result of the growing number of partners, which is allowing Pagaya to access an increasing volume of loan applicants. In this sense, the company announced a few weeks ago the incorporation of another new top-5 bank, which will become the second top-5 bank partnership (the first was US Bank). They are also in negotiations with several top-20 banks.

On the other hand, operating margins are improving, showing a steady increase in operational efficiency. This efficiency is measured by Pagaya with the FRLPC (Fee Revenue Production Cost) parameter, which has been growing constantly during the last quarters:

Pagaya

Source: Pagaya

As you can see, the business has grown steadily over the past few quarters. However, this good revenue performance has not been reflected in the earnings of recent quarters. If we look at the income statement for the last two quarters (Q2 and Q3) there is a loss item “other expenses” that has presented high amounts. This item has included various expense items such as stock-based compensation (SBC), loan and securities impairments, etc. It is in “impairments of loans and securities” where the key lies for Pagaya to reach the GAAP profitability milestone in the coming quarters and where the market will be focused. This accounting item includes the losses caused by the loans that Pagaya maintains on its balance sheet, losses that have reached high figures ($56M in Q2 and $82M in Q3). According to Pagaya, this has been due to the fact that, although the loans have shown good performance in terms of delinquencies as of 2023, the high financial costs incurred in obtaining the funds have meant a narrowing of the margins and there have not been a sufficient cushion to absorb loan defaults. This situation, according to Pagaya, is only occurring with loans granted in 2023. Starting in 2024 and thanks to the reduction in interest rates, the lower cost of funds has made it possible to increase the sufficient cushion to absorb future defaults. In the third quarter CC, the company stated that of those 2023 loans without sufficient cushion, there is still $275 million in balance and that they believe the latest impairments associated with them will be resolved in the upcoming fourth quarter of 2024. If this is so true the goal of a positive GAAP EPS would not be far away. In fact, Pagaya estimates that it will be achieved throughout 2025.

Evolution of impairments of certain loans and loan holdings on the balance sheet:

|| || ||Q1 2023|Q2 2023|Q3 2023|Q4 2023|Q1 2024|Q2 2024|Q3 2024| |Impairments on certain loans and securities|$21.4M|$4.23M|$9.13M|$12.6M|$26.85M|$80M|$81.8M| |Loans in BS|$503.8M|$588.31M(16,6%)|$665.45M (13,09%)|$714M (7,3%)|$892M (25%)|$909M (1,9%)|$912M (0,33%)|

Source: Author

In the table above you can clearly see two well-defined trends during the last quarters:

1- Growing trend of impairments.

2- The decreasing trend of loans and securities retained on the balance sheet.

In terms of impairments, the greatest growth has occurred in Q2 and Q3 of the current year 2024. Impairments are also expected for the next Q4, although they will most likely be lower than those recorded in Q3 ($81.8M) since only $275M originated in 2023 remains currently in balance. And starting in the first quarter of 2025, the number of these impairments is very likely to be drastically reduced. This downward evolution will be the key for Pagaya to achieve the positive GAAP EPS target.

Looking at the loans held on the balance sheet, you can see from the chart above that growth is clearly slowing. This is because, although the volume of loans generated is increasing, the % risk retention has been falling from more than 5% last year 2023 to an average of 2.5%-3% today thanks to new financing structures with lower requirements.

Therefore, decreasing the evolution of the impairments of loans and certain securities and decreasing the evolution of the holding of loans on the balance sheet; are two fundamental objectives for Pagaya for next year 2025.

Pagaya stock valuation>>> Only X3,5 current year 2024 Adjusted EBITDA

Pagaya estimates that the adjusted EBITDA for the current year 2024 will be around $200M. This is only X3.5 of the current market value ($700 million). In reality, it is a very very low valuation, taking into account that the average peers´s valuations are above x20.

So if we compare it to some of its peers: Sofi (Nasdaq:Sofi) Adjusted EBITDA X21 and MoneyLion (Nasdaq:ML) X24.

We are saying that for Pagaya to approach the market valuation of its peers, it would have to be valued at around $4B ($200MX20), that is, about $60 per share.

Although it may seem like a high price compared to the current price ($10.50 at the time of writing this article), if the results of the next quarters show enough business growth, and above all, it is possible to achieve GAAP profitability, I am convinced that that price ($60) could be reached without problems in a few months.

Risks

As with any company, there are a series of risks that every investor must take into account:

There is a risk that Pagya will ultimately fail to reduce impairments and, therefore, GAPP's profitability target will not be achieved throughout next year 2025.

On the other hand, since Pagaya still has negative net cash flow, it may have to make some offerings in the coming months to increase liquidity.

Conclusion

Pagaya presented its third quarter 2024 results on November 12. Results were mixed, with revenue of $258 million and GAAP EPS of -$0.93.

Although the revenue figure has been higher than expected, the GAAP EPS figure has been lower. The reason has been an expense item "credit impairment of certain loans and securities" that has been much higher than expected. This expense item has its origin in losses on loans granted in 2023 due to high financial costs that caused a narrowing of margins.

Pagaya affirms that these impairments will end up being cleaned in the next Q4 of 2024, and from 2025 the amount will decrease, making it easier to achieve the GAAP profitable objective.

With a current market valuation of just 3.5 times adjusted EBITDA, Pagaya is severely undervalued. Looking at the valuations of its peers, the stock price should be around $60. We are, therefore, facing a company that has impressive revaluation potential and that I believe will finally explode throughout next year 2025.